Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. For more information, including examples of reimbursable and non-reimbursable expenses and roles and responsibilities, see Business and Travel Expenses on Fingate. Exceptions to policy must be approved by the appropriate VP/Dean’s office or designee. If the individual incurring the expense is not an employee of the university, additional requirements apply.

Policy Chapters

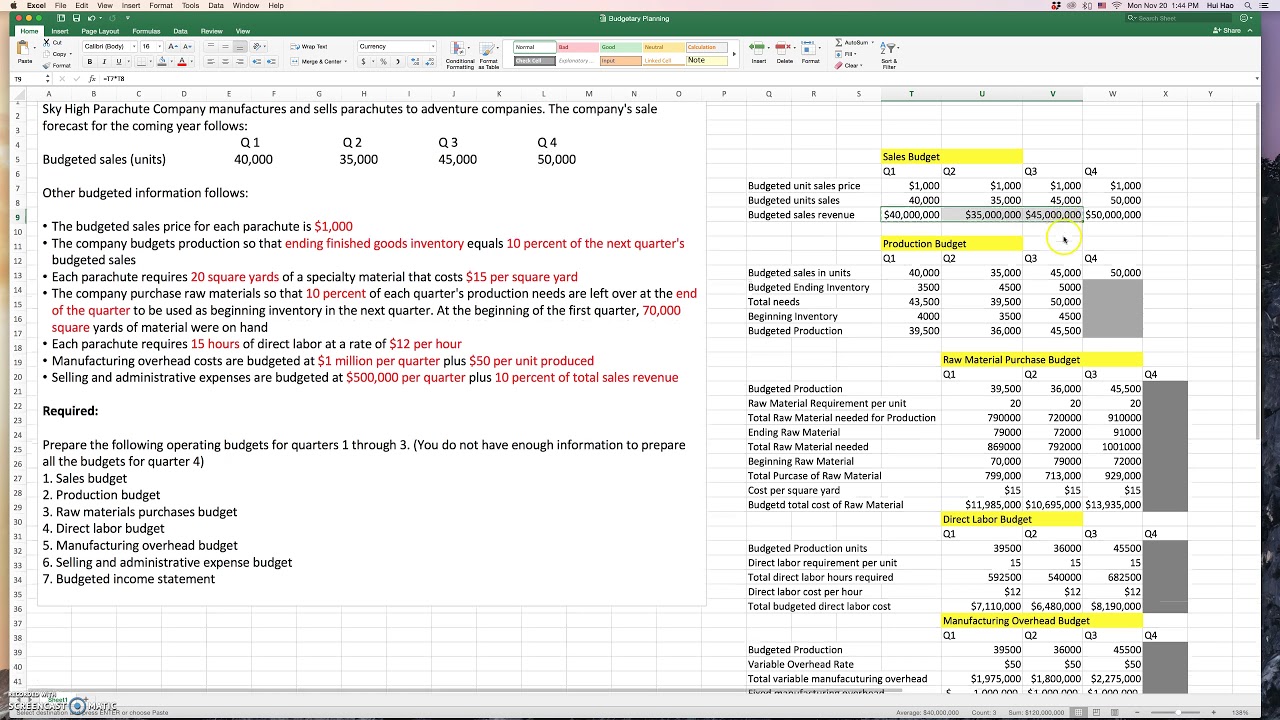

Selling, general & administrative costs (SG&A)—also sometimes referred to as operating expenses—are any costs your business pays that aren’t directly tied to making or delivering your product or service. One way to classify expenditures is by whether they are fixed or variable. When a business develops its operating budget, it must classify its expenditures as either fixed or variable. This is important because how an expense is classified affects a firm’s net income.

Establish Accounting Periods and Methods

If your SG&A ratio is higher than the industry average, it may indicate that your business is overspending on administrative and operational costs. To calculate the SG&A expense ratio, businesses must first determine which expenses fall under the SG&A category. The SG&A expense category includes costs related to sales, marketing, administration, research and development, and general operations of the business. The administrative budget is for most things not related to manufacturing or production. Both these types of budgets can be created for the month, quarter, or year (or virtually any period). The administrative budget can be broken down into separate budgets so that sales and marketing are also included.

Do you already work with a financial advisor?

Cutting the cost of goods sold (COGS) can be tough to do without damaging the quality of the product. Cutting operating expenses can be less damaging to the core business but may affect things like employee satisfaction or customer service. SG&A costs are typically reduced after a company merger or acquisition which makes it possible to reduce redundancies. Direct selling expenses are incurred only when the product is sold and are related to the fulfillment of orders.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Generally speaking, the lower a company’s SG&A expense, the better – since that implies the company is more profitable, all else being equal. For example, let’s say that we have a company with $6 million in SG&A and $24 million in total revenue. While rather uncommon in practice, a company’s SG&A expense can be derived by rearranging the first formula. The difference between the SG&A expense and cost of goods sold (COGS) line item is as follows. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- The administrative budget is for most things not related to manufacturing or production.

- Larger companies often separate these types of costs into smaller, specific SG&A categories because it’s often easier for companies to track and monitor costs in these groups.

- When an outside institution or entity funds travel on that organization’s behalf and provides full payment for those travel expenses, the trip is considered externally sponsored.

- It is not customary to include a cash requirements calculation as part of this budget.

For example, a company’s marketing budget will certainly be reviewed independently of its engineering expenses. However, it could be useful to review marketing and sales expenses together as one group relative to sales or sales growth. These choices are at management’s discretion based on the company’s business model and objectives. Net revenue is always reported at the top, then the cost of goods sold (COGS) is deducted to arrive at the gross margin.

By leveraging the purchasing power of the organization, businesses can negotiate better prices and terms for the goods and services they need. This can result in significant cost savings over time and free up resources for other important initiatives. Additionally, implementing a system for tracking and analyzing spending can help identify areas where costs can be reduced or optimized, leading to greater efficiency and effectiveness in SG&A spending. By streamlining processes, investing in technology that automates tasks, and outsouring activities, businesses can reduce manual labor costs and allocate resources toward more profitable activities. Another key consideration when analyzing SG&A expenses is the impact of external factors, such as economic conditions or changes in regulations.

Instead, managers use the general level of corporate activity to determine the appropriate level of expenditure. This can involve activity-based costing analysis to determine which activities are likely to be needed more or less as sales levels and capital spending change. There may also be some impact of bottleneck operations on the amount of expenditures in this budget (especially if the bottleneck is in the sales department). When creating this budget, it is useful to determine the activity levels at which step costs may be incurred, and to incorporate them into the budget. The selling and administrative expense budget is comprised of the budgets of all non-manufacturing departments, such as the sales, marketing, accounting, engineering, and facilities departments. In aggregate, this budget can rival the size of the production budget, and so is worthy of considerable attention.

Kommentare von fouad